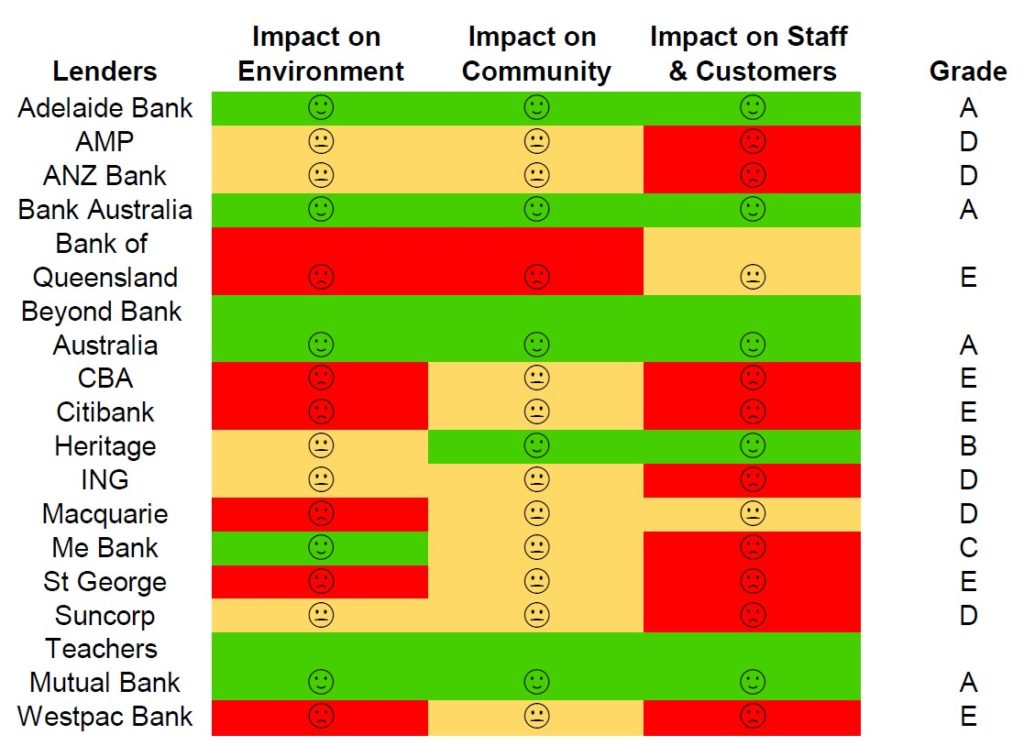

If your bank is hurting customers or burning up the planet on fossil fuel projects, they’re doing it with your money. You have the right to know how your bank spends their money. Ethical or not, banks should prioritise their customers first. This table assesses popular Australian banks on their impact on the:

- Community (do they fund community shelters or casinos?)

- Environment (are they polluting or helping our planet?)

- Customers and Staff (do they reward or exploit them?)

Read on past the table to learn why your bank got that score.

Read on to learn more about:

How do you score banks?

For environmental impact, we use credible sources such as Market Forces. Market Forces exists to hold banks accountable for their carbon footprint. For community impact and staff & customer treatment, we use sources provided by banks and trustworthy third parties, such as the Banking Royal Commission and ABC News. Of course, some banks talk about their good behaviour and hide the bad stuff, but we do our best to look past that.

All of this information is publicly available – we’ve just dug a bit deeper and interpreted the findings with industry insight. As ethical brokers, we’re independent of any bank so there’s no conflict of interest with this table.

For each category, a bank is awarded a score out of 3.

- 1 = doing harm

- 2 = doing no harm

- 3 = doing good

The bank’s average score across the three categories is converted to a score out of 100.

What do the ratings mean?

Doing harm

Environment – funding fossil fuels, pollution & eco destruction.

Community – funding gambling, tobacco, arms, pornography, trafficking industries or another humanitarian issue.

Customers & staff – has mistreated staff and/or customers; high-ranking staff have abused their position.

Not doing/avoiding harm

Environment – not funding or divested from fossil fuels.

Community – no bad connections and/or small community involvement but only focused on their profit.

Customers & staff – previous corruption or scandal (being addressed).

Doing good

Environment – reducing their carbon footprint; supporting areas that benefit the environment e.g. renewables, planting trees, bushfire recovery.

Community – working with charities, community organisations and/or run their own foundation.

Customers & staff – transparent supply chain; clean track record.

What should I do?

It’s never to late to walk away from a bank. Tell them why you’re leaving – maybe it’ll encourage them to change their behaviour. You deserve to bank with someone you trust to do good, not harm, with your money.

Already got a home loan? You can always refinance with a more ethical bank. You’ll almost certainly get a better rate refinancing now, due to the low interest rates brought on by the economic recession.

If your bank wasn’t listed here – watch this space. We’re in the process of assessing more banks so you can know where your money is going.

Generally, you’re often better off with a mutual or ethical bank. By design, they are owned by customers and don’t have shareholders. At the same time, you shouldn’t have to pay any extra to go with a better bank. Talk to us for help securing the best deal with a bank that uses your money in a way you want.

Alternatively, read more about how you can engage in ethical investments today.

Disclaimer: The information provided is general in nature and does not constitute financial advice. Please speak to us for recommendations on your individual circumstance and requirements.